💵 USA Mortgage Information Best Info 2025✨

Want money to begin your dream enterprise, purchase your first residence, or lastly repay these nagging bank cards? The best mortgage within the USA might be your ticket to monetary freedom. However wait—earlier than you signal something, let’s decode your complete lending maze for you! 🔍

🧭 Chapter 1: Understanding the U.S. Mortgage Panorama

USA Mortgage:

America mortgage market is huge—similar to the nation itself! From federal scholar loans to non-public payday loans, there’s a mortgage for almost each want. However navigating this sea of lenders, rates of interest, and reimbursement phrases can really feel like wandering by way of Instances Sq. blindfolded. 😵💫

Let’s break it down 👇

🏦 Varieties of Loans within the USA

- Private Loans 💰

- Use: Emergency bills, residence repairs, weddings, and even debt consolidation.

- Lenders: Banks, credit score unions, on-line lenders.

- Phrases: 6 months to 7 years.

- Scholar Loans 🎓

- Use: Tuition, books, residing bills.

- Lenders: Federal (by way of FAFSA), or non-public lenders.

- Tip: Federal loans provide versatile reimbursement and forgiveness choices.

- Mortgage Loans 🏡

- Use: To purchase or refinance a house.

- Sorts: FHA, VA, typical, jumbo.

- Down Funds: As little as 3% for certified debtors.

- Auto Loans 🚗

- Use: Purchase new or used autos.

- Time period: 2-7 years.

- Tip: The next credit score rating = decrease rates of interest.

- Enterprise Loans 🧑💼

- Use: Startups, expansions, gear, working capital.

- Choices: SBA loans, strains of credit score, bill financing.

- Payday Loans ⚠️

- Use: Quick-term emergency money.

- Warning: Excessive curiosity—can result in a debt entice! Proceed with warning.

💳 Chapter 2: Credit score Scores – Your Golden Ticket 🎟️

✨ Hook: Need higher charges and extra approval probabilities? All of it begins along with your credit score rating! 📈

Within the U.S., your credit score rating is your monetary status. It tells lenders how reliable you might be with cash.

🔢 Credit score Rating Ranges

- Wonderful: 800+

- Very Good: 740–799

- Good: 670–739

- Truthful: 580–669

- Poor: Under 580

✅ Why It Issues

The upper your credit score rating, the higher your probabilities of:

- Getting authorised for loans 💼

- Receiving decrease rates of interest 🤑

- Accessing increased mortgage quantities 💲

🛠️ Tricks to Enhance Your Rating

- Pay payments on time ⏰

- Scale back bank card balances 💳

- Keep away from onerous inquiries 📉

- Maintain outdated accounts open 🕰️

📝 Chapter 3: Making use of for a Mortgage within the USA

💥 Hook: Making use of for a mortgage doesn’t must be anxious—in the event you observe the fitting steps! 🪜

🪪 Step-by-Step Course of

- Know Your Objective

Are you borrowing for varsity, a automobile, a trip, or one thing else? The rationale determines the very best mortgage kind. - Examine Your Credit score Report

Use free instruments like Credit score Karma or AnnualCreditReport.com. - Examine Lenders

Don’t simply go along with the primary provide. Store round for higher charges, phrases, and perks. - Collect Documentation

You’ll sometimes want:- Authorities ID 🪪

- Social Safety Quantity 🧾

- Proof of earnings (pay stubs, tax returns) 💼

- Employment verification 🏢

- Apply On-line or In-Individual

On-line lenders provide quick approvals, whereas banks could present extra customized service. - Evaluate Phrases Fastidiously

Look ahead to:- Rates of interest (APR) 📉

- Reimbursement phrases 🗓️

- Charges: origination, prepayment, late cost ⚠️

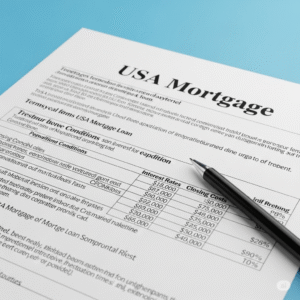

🧮 Chapter 4: Curiosity Charges & Reimbursement Plans

📊 Hook: Your rate of interest might imply paying 1000’s extra—or much less—over time! Select properly. 💡

📉 Mounted vs. Variable Curiosity

- Mounted: Doesn’t change over time. Nice for long-term planning.

- Variable: Adjustments with the market—riskier however can begin decrease.

📆 Widespread Reimbursement Plans

- Normal: Mounted month-to-month funds.

- Graduated: Begins low, will increase over time.

- Revenue–Pushed (for scholar loans): Based mostly on what you earn.

- Balloon Funds: Low month-to-month funds with an enormous lump sum on the finish (riskier).

⚠️ Chapter 5: Widespread Mortgage Traps to Keep away from

🚨 Hook: Not all loans are created equal—and a few are downright harmful!

❌ Purple Flags

- Sky-high rates of interest (APR over 36%)

- Hidden charges for processing or early reimbursement

- Aggressive advertising ways

- Lack of regulation or license (particularly on-line lenders)

🧠 Professional Ideas

- Keep away from payday loans if attainable 🛑

- By no means give private data to unknown lenders

- Learn opinions and confirm the lender’s credentials

- If it sounds too good to be true—it most likely is

💼 Chapter 6: Enterprise Loans within the USA – Gas Your Hustle 🚀

Beginning a enterprise within the U.S.? You’re going to wish money circulation. Let’s discover your funding choices.

🏦 SBA Loans

- Backed by the federal government

- Low-interest charges

- Strict eligibility, however value it

🔄 Enterprise Traces of Credit score

- Much like a bank card

- Borrow what you want, once you want

- Nice for managing money circulation

🤝 Peer-to-Peer Lending

- Platforms like LendingClub or Fundera

- Simpler entry, however charges could also be increased

🛠️ Tools Financing

- Use it to purchase costly equipment

- Tools serves as collateral

🏡 Chapter 7: Mortgage Loans – Your Path to the American Dream 🌟

Shopping for a house? You’ll probably want a mortgage. Right here’s what you must know:

🧾 Mortgage Mortgage Sorts

- Standard Loans – Not government-backed

- FHA Loans – Low credit score rating and down cost okay

- VA Loans – For U.S. veterans, no down cost

- USDA Loans – For rural properties, low-to-moderate earnings

🧠 Mortgage Phrases to Know

- Principal – The mortgage quantity

- Curiosity – What you pay to borrow

- Escrow – Taxes & insurance coverage funds

- PMI – Non-public Mortgage Insurance coverage (if <20% down)

🎓 Chapter 8: Scholar Loans – Put money into Your Future 🎯

Training is dear—however loans can assist bridge the hole.

🏛️ Federal vs. Non-public

- Federal: Safer, extra versatile

- Non-public: Might provide higher charges, however fewer protections

📚 Federal Mortgage Sorts

- Direct Backed: Gov pays curiosity whereas at school

- Direct Unsubsidized: You’re liable for curiosity

- PLUS Loans: For fogeys or grad college students

🧮 Reimbursement Plans

- Normal, Graduated, Revenue–Pushed

- Forgiveness applications (PSLF, Instructor Mortgage Forgiveness)

🔁 Chapter 9: Refinancing & Consolidation – Sensible Cash Strikes 🧠💡

🔄 Hook: Need to save 1000’s? Refinance or consolidate your loans!

🔄 What’s Refinancing?

- Exchange your outdated mortgage with a brand new one at higher phrases.

- Finest for scholar, mortgage, or auto loans.

- Requires good credit score.

🧲 What’s Consolidation?

- Mix a number of loans into one

- Simplifies cost, however could lengthen time period

🧠 Chapter 10: Sensible Borrowing Ideas – Be a Mortgage Ninja! 🥷💼

- Borrow solely what you want

- Know your numbers (APR, time period, complete value)

- Keep away from impulse borrowing

- Construct your credit score early

- Have a reimbursement plan earlier than signing

📌 Ultimate Phrases: Your Mortgage, Your Future 🔮

Loans within the USA can unlock highly effective alternatives—from launching your dream enterprise 🧑💼, incomes a university diploma 🎓, or shopping for that cozy residence 🏡.

However keep in mind this: a mortgage is a device, not free cash. Use it properly, perceive the phrases, and don’t borrow greater than you’ll be able to afford to repay.

🧾 Abstract Guidelines – Earlier than You Borrow ✅

| Step | Motion | ✅ |

|---|---|---|

| 1 | Know your credit score rating | ✔️ |

| 2 | Select the fitting mortgage kind | ✔️ |

| 3 | Examine a number of lenders | ✔️ |

| 4 | Learn the tremendous print | ✔️ |

| 5 | Plan your reimbursement | ✔️ |

🙋 FAQs About Loans within the USA

Q1: Can non-citizens get loans within the USA?

A: Sure! Many lenders provide loans to everlasting residents and even visa holders, although phrases could fluctuate.

Q2: Is it attainable to get a mortgage with weak credit?

A: Completely—however anticipate increased rates of interest. Contemplate a co-signer or secured mortgage.

Q3: Are there 0% curiosity loans?

A: Uncommon, however attainable by way of promotions or particular lenders (like some bank cards or Purchase Now, Pay Later platforms).

This fall: What’s the most secure mortgage to get?

A: Federal scholar loans or SBA enterprise loans have a tendency to supply probably the most borrower-friendly phrases.

🚀 Able to borrow smarter, not tougher? Take your time, do your analysis, and select the mortgage that lifts you—not buries you. Your monetary future is in your arms! 💪🇺🇸